Trends in Charitable Giving: How to Give

April 2, 2020

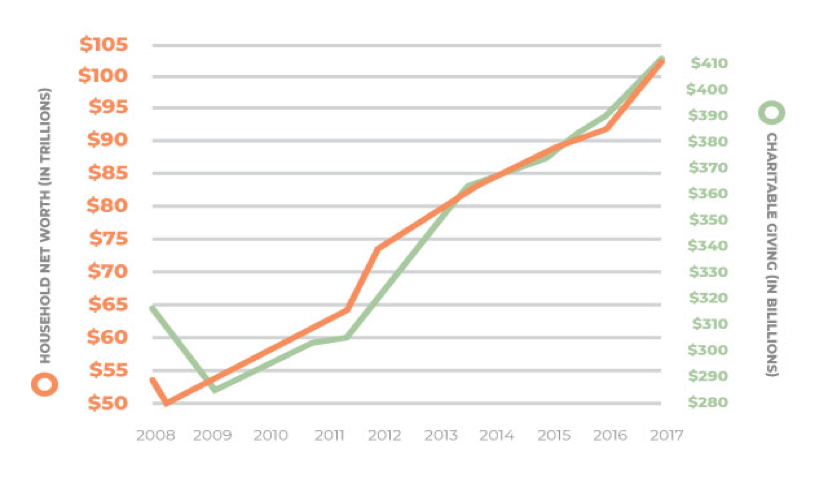

According to Giving USA 2019, Americans gave an estimated $427.71 billion to charity in 2018. That’s the highest total in more than 60 years since the report was first published, and also, second-time ever over $400 billion was given to charity. As you can see in the chart below, giving tends to trail household net worth by one year.

Chart Source: Federal Reserve, 2019

When giving to charity, donors either want to support an organization or cause they care about, or they want to leave a legacy through their support. Donors may choose to provide a donation with cash; however, some see that supporting non-profits may generate tax benefits and they opt to maximize both the gift and the potential tax benefit for themselves.

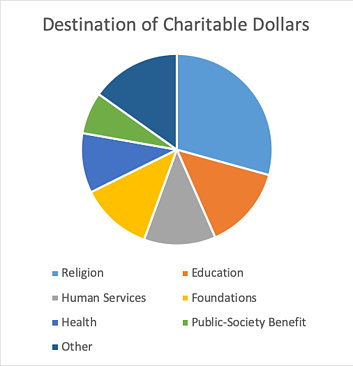

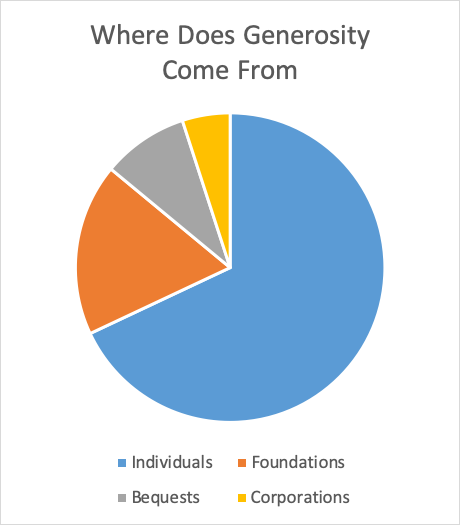

When it comes to charitable giving, the biggest portion each year consistently goes to churches and religious organizations. Data from 2018 shows that these organizations received around 31% of all donations in the United States. The money that is donated, not only to these, but to all organizations mostly comes from individuals.

Chart Source: Giving USA Foundation, 2018

Because a majority of charitable gifts come from individuals, it is important to understand the different ways to provide support to your local charities, non-profits, and religious organizations. As an individual, you can provide:

Direct Gifts

These are contributions made directly to charitable organizations. Direct gifts may be deductible from income taxes depending on your individual situation. These gifts go straight to the organization for them to decide what to do with and how to use the gifts. For some, these are the most important as they keep the lights on.

Gifts Toward an Endowment

An endowment is fund of money that is used to create income. The principle is either not touched or has restrictions on it, while the income generated is used each year on projects or daily expenses. Endowments are great to allow an organization to continually have income each year.

Charitable Remainder Trusts

Under this arrangement, the donor gives money, securities, or real estate, and in return, the charitable organization agrees to pay the donor a fixed income or fixed percentage of income. Upon the death of the donor, the assets pass to the charitable organization. Charitable gift annuities enable donors to receive consistent income and potentially manage taxes.

Gifting in a Will

A person’s Last Will and Testament is often overlooked as a way to donate money to organizations. Along with bequeathing valuables or money to heirs, the Will can also gift items, cash, or investments to a charitable organization. While this does help with estate taxes if there are some, this is mainly a person’s last way to make an impact on an organization that touched them greatly. These gifts are often never expected by the organization, but they are some of the most cherished.

Some people are comfortable with their current gifting strategies. Others, however, may want a more advanced strategy that can maximize their gift and generate potential tax benefits. A financial professional can help you assess which approach may work best for you.

Remember, the information in this article is not intended as tax or legal advice. And it may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.

Matt Riley was named Fiduciary Officer and VP for First National Bank and Trust Company in December 2018, helping clients to meet their prosperity goals through investment and estate planning. Prior to joining FNBT, Matt had risk and compliance analysis experience at State Farm Bank in Bloomington, Ill. Matt is a proud Illinois State University Alumni, receiving his B.S. in Finance with an emphasis in Financial Planning. He has continued his education journey, earning other designations including the Chartered Financial Consultant designation. In addition to his bank service, Matt became a member of the Clinton Rotary Club in April of 2019 and became a board member for the Warner Hospital & Health Services Foundation in May of 2019.

About First National Bank and Trust Co: First National Bank & Trust Company is a community bank located in Clinton, Illinois. Dedicated to community prosperity, the bank was chartered in 1872 under the name DeWitt County National Bank. The name was changed First National Bank and Trust Company in 1974, and was acquired by TS Banking Group in 2017. With $186 million in assets, First National Bank is dedicated to community reinvestment and gives 10% of its net income back to the community. For more information visit firstnbtc.com.